10 Rarely Known Facts About the Forex Market

admin

- 0

Most traders are unaware of just how massive the Forex market is. With trillions of dollars worth of spot transactions, Fx, and currency swaps, this is the largest financial market in the world. Because of this, some of the largest financial institutions are heavily invested in it.

Interestingly, the US dollar is the highest traded currency and is on one side of over 90% of trades made in the FX market. So what is there to know about the Forex market? Here are ten rarely known facts about this market.

Minimal Government Regulation

While other investments are highly regulated, the Fx market transcends boundaries and modern trade rules. For this reason, regulation is limited, making it a system without a central location for traders to converge. This minimal regulation also makes it accessible to traders on every level.

Ready Access to Trade Information

All traders in the FX market have access to information flow. Unlike other markets where pro traders have a competitive edge, every trader has access to the same information and market dynamics. This democratic way of trading provides a level playing field because everyone operates from the same platform.

Large Financial Institutions Account for 94% of FX Trading Volumes

Multinational corporations, Hedge funds, and investment banks take up the bulk of trades in the FX market. Contrary to popular belief, retail trading has a minimal investment portfolio, accounting for less than 6% of the entire Fx market. While there is a lot of money to be made from this financial market, it is rarely achieved from retail trading, with up to 99% of new traders recording losses in their first year.

Majority of Trades Happen in the United Kingdom

Although the US dollar is the highest traded currency in the Fx market, most trades occur in the UK. Of the 80% share taken by US, Hongkong, Singapore, and Japan, the UK contributes 43.1 percent to the total fx turnover globally. It is fascinating that the US comes in a distant second with only 16.5 percentage, almost a third of the UK’s contribution.

The FX market trades $2 Trillion worth of Spot Transactions Daily

This market is ranked as a colossal financial entity because it trades a combined and overwhelming $6.5 trillion worth of transactions daily! Of this figure, $2 trillion accounts for spot transactions while the rest spreads across currency swaps, options, forwards, and fx swaps.

No financial market comes close to these figures, and none of them is as efficiently run.

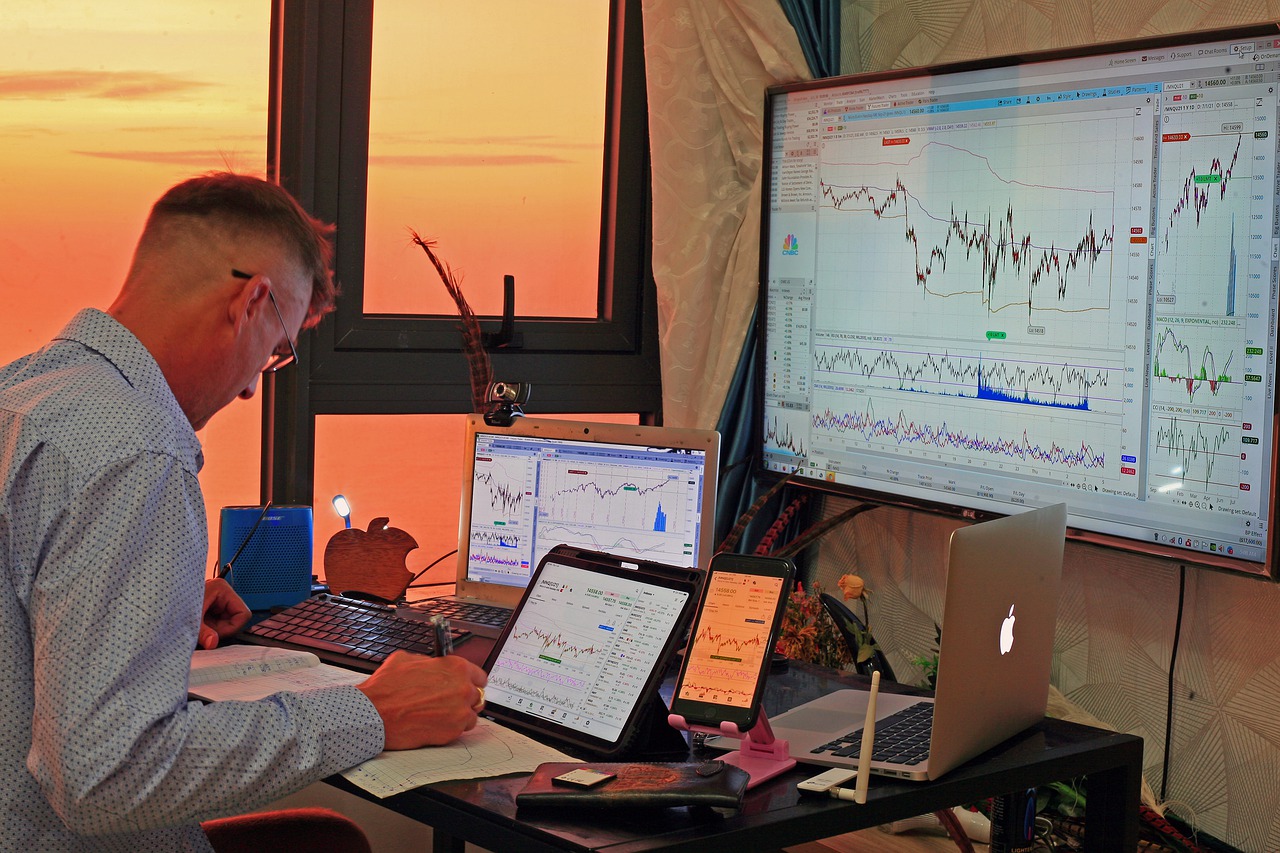

Most Transactions Occur Online

Forex trading has become the global force it is today, thanks mainly to online trading. Now traders can perform, monitor, and close trades in real-time and from the comfort of their living rooms. Fx trading has now become a digital market, with very few transactions occurring on the trading floor.

The FX Market trades 170 Different Currencies

Although there are only about 7 frequently traded currencies in the FX market, it trades hundreds of currency pairs daily. The Euro, Yen, GBP, Chinese Yuan, Canadian Dollar, and Swiss frank make up 70% of the entire trading volume. However, there are 170 different pair options to choose from.

Minimal Operational Costs

One of the key perks of Fx trading is that you can profit from it with very little investment capital. Other trading markets charge commissions and require an extensive portfolio, but in Fx trading, you only incur a transaction fee that is less than 0.01% of investment capital.

This feature makes the fx market a lucrative and attractive option for retail traders and multinational companies alike.

Women Outperform Men in the FX Market

Unlike other trade markets, women in Fx trading are more intuitive when taking calculated risks. There are very few women in this field, only about 10%, but they are meticulous when investing in financial markets.

Unlike men, women are less likely to break patterns and trading rules.

Retail Traders cannot trade Bitcoins in the UK

Although cryptocurrency is considered a legitimate entity in many markets, its high volatility makes it risky. This high-risk factor prompted the FCA to ban crypto-trading in the UK.

Verdict

For beginners seeking to enter the retail market, it is critical to note that it has a very high risk to reward ratio. Note that speculating on market forces may seem easy, but it is considered an exact sport. In the same way you can win big in fx trading, you can also lose your entire investment without warning.