5 Ways to Avoid Day Trading Burnout

admin

- 0

After months or even years of watching the charts, plotting moving averages, deciding you next move, it may reach a point where you mind is not in the game. You may notice that you are making silly mistakes and taking a beating in the market when this happens. Don’t fret, what you are experiencing is day trading burnout and it affects every other day trader.

There are several proven strategies you can adopt to avoid trading burnout. At the same time, you also need to know what you must do when you experience it so that you can avoid making losses.

Proven Ways to Avoid Day Trading Burnout

1. Make sure You Have A Daily Trading Schedule and Follow it

Don’t just wait for the markets to open and start trading without a scheduled plan. You might find it easier to have a daily pre-planned routine that you can tweak to fit your circumstances. For instance, pro-traders usually start their day by having a sneak peek of the market opening. They then take a short coffee break to plan their trading activities.

The beauty of having a daily trading schedule as an online day trader is that you can play around with it to fit your lifestyle. For instance, you can plan to have a gym break in between trades as you wait for the markets to shift depending on your trading strategy.

2. Try New Working Hours and Markets

If you are finding yourself feeling out of touchand tired of working the same hours, you canswitch your hours by exploring markets in a different time zone. The advantage of trading online is that you can switch to foreign markets that operate on a different schedule with the click of a button. This way you can work at any time you want and not suffer from the burnout that comes with daily routines.

3. Consider Using A Botfor Routine Trades

Day trading bots are becoming better and better each day but they are not a replacement for traditional trading methods. However, you can use them to take care of those routine trades each day or have them implement your trading strategy. If you are using a modern digital trading platform, the automation you have in it can help you automate repetitive trading tasks like closing trades when conditions are met.

4. Know When Things Are Not Going Your Way

Most traders experience serious trading burnout when they are on a prolonged losing streak or in extreme market conditions. For instance, you are likely to be under a lot of stress and burnout when there is uncertainty in the markets like in a recession or just before a major regulatory announcement.

It’s best to take a step back or just pause trading when you are not making progress or when there is too much chaos in the market especially if you are new to day trading. Of course, some experienced traders thrive in extreme market conditions but there is no use hanging in there when you are being battered.

5. Find Someone toTrade with Or Hang withWhile Trading

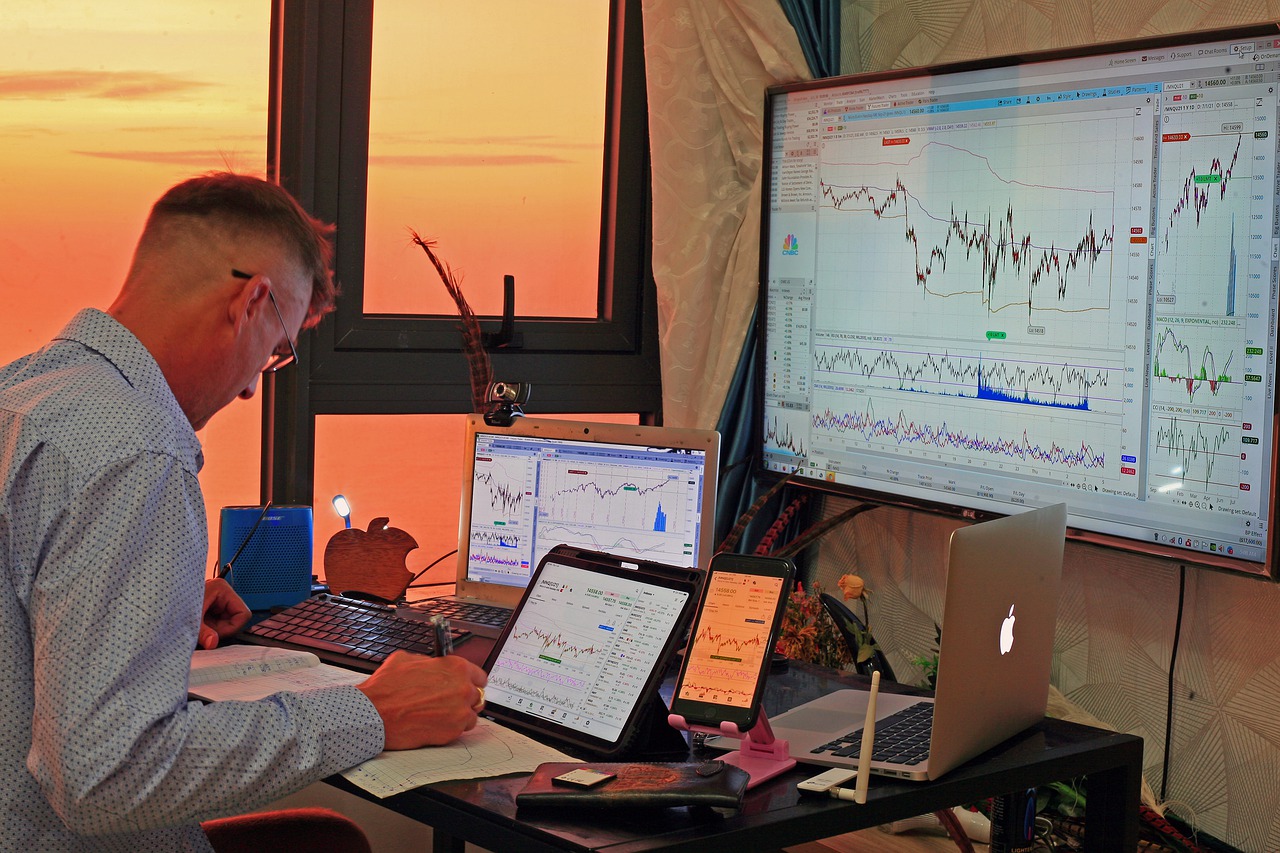

Studies show that people who work alone are more likely to experience mental burnout. This is often the case with online day traders who prefer to work from the comfort of their homes or personal cubicle.

You can prevent burnout by either finding a person to share your working space with or moving to a co-working space. Preferably the person you choose to work with or share a working space with should have the same interests in day trading as you so you can have meaningful conversations.

What Can You Do If You Experience Burnout?

If you are experiencing day trading burnout, the most recommended solution is to take a break and do something unrelated to trading. Find a hobby, take a trip or just go to the gym. However, it’s always good to keep the momentum especially if you are performing well so don’t go away for too long.

You can also remind yourself why you got into day trading in the first place and what motivates you to keep doing it every day. For instance, most people find the freedom to work at their own time and wherever they are a good reason to keep on trading. Others use money as the motivation to hit the markets.